Business

Fraud Prevention

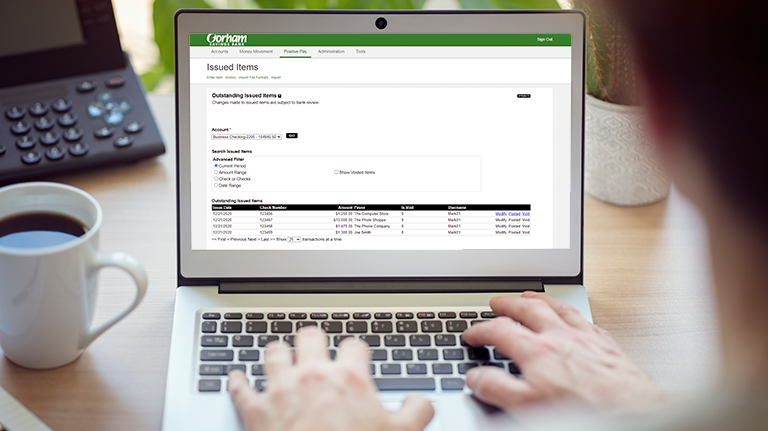

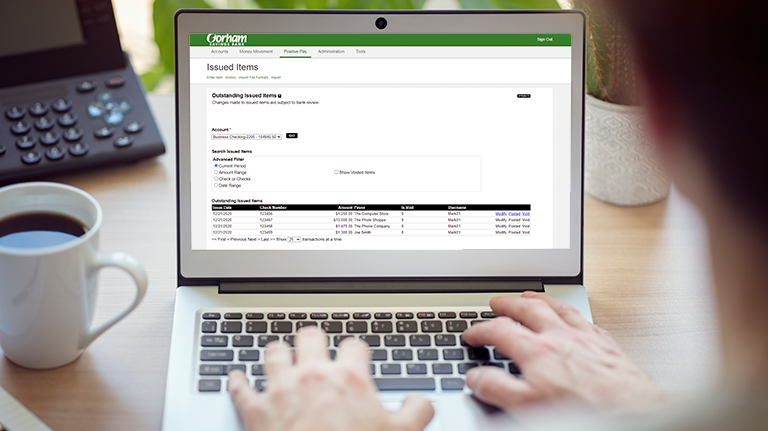

Protect your account from check fraud losses and enjoy peace of mind with Positive Pay. You provide us with information about issued checks in Online Banking, and we review and match them to pending transactions. Transactions that don’t match are flagged for your review, giving you the power to authorize or decline the payment.

- Manage exceptions and make decisions to pay/return online

- Identify and reduce check fraud and errors quickly

- Get a daily report of any suspected fraudulent or mismatched items

- Reduce time spent on account reconciliation

Is Your Business

Protected From Fraud?

Get started with ACH Positive Pay to help reduce your electronic fraud risk. Only ACH transactions from companies you have pre-authorized will be allowed to clear your account, and you can specify the exact or maximum amount authorized. Choose to block all ACH transactions, or block only ACH debit.

"Until the incident, we didn’t realize that commercial customers aren’t protected in the same way as individuals. Now, we use Positive Pay so GSB knows what to expect. It’s nice to know they’re [GSB is] looking out for us. Positive Pay gives us peace of mind."

LET’S TALK

Complete this form and a member of our team will be in touch. Prefer the phone? Give us a call at (207) 221-8460